Customer Retention & Cohort Analysis

- Marek Vavrovic

- Apr 30, 2022

- 3 min read

Customer cohort analysis is beneficial in marketing and business use cases. For subscription & non-subscription businesses. Companies use cohort analysis to analyze customer behavior across the life cycle of each customer.

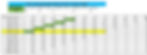

Cohort Analysis organizes data by initial (first) purchase month of customers, and stream of subsequent purchases through time.

Data

How to read this table?

Let's say we want to get a customer to purchase our product for the first time. We pay to Facebook to catch a customer for us. We are SaaS company selling a software subscription for 50£ per month.

Start Month 0 represents a month when a customer or number of customers bought the product for a very first time.

Start Month (1 to 11) represents recurring subscription payments. How many customers stay with us and pay for the subscription in the next months.

May Cohort: Cohort is May because the initial purchase happened in May. All the customers that purchased for the very first time in May we look at in the yellow row. 26 people purchased in May. 7 months later, from the initial 26 customers 15 of them is still paying for the subscription we had sold them. We are looking at a stream of subsequent purchases through time based on the initial purchased month.

To calculate how many purchased we had in total in May we

look at the May Cohort value which is 26.

we go backwards. The May Cohort value from April Cohort is an intersection of Apr Cohort and Start Month (1), which represents the second payment of a customer that started with us in April.

we repeat this for all the rows, summarize the numbers and get 108 customers bought a subscription from us in May in total. If someone bought from us for the first time in January and in May is still with us, this customer will be included in the May total figure. To understand this, you must go diagonally.

How to calculate the Customer Retention?

To calculate this, we need to divide remaining customers in the individual months by its initial value.

For example, to obtain the value for Jan Cohort in the 6th month divide 22/35.

This tells us than 100% of customers that purchased for the very first time in January remain with us until February (Start Month 1) and in March we have lost 14 % of the initial Jan Cohort customers because just 86 % of them left with us until March (Start Month 2).

After 12 months of relationship with the company we still have 26 % of them (Start Month 11).

What are the empty cells?

The empty cells are a period in the future. Let's say that December is the last period we have data for. Dec Cohort & Start Month 1 doesn't happen yet. If these values are for 2021 and customers pay by the end of the month we are now in January 2022 and last data, we have is for Dec_2021.

The second table shows us how much revenue the customers are generating for us in each month.

Formula: Monthly Subscription Price * number or remaining customers.

Cumulative Lifetime Revenue by Cohort

This helps you to understand if you get a customer how much revenue you can expect in year from now.

Customer Lifetime Revenue by Cohort

This tells us that on average for each customer that we are acquired we made 401£

Formula: Initial Customer Count / Cumulative Lifetime Revenue.

Some customers dropped off, some stayed with us. So, some of them paid more, some of them less, but on average in Jan Cohort we made these 401£.

This shows us that within a year on average we are going to made 400£ on each customer.

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) is the cost related to acquiring a new customer. In other words, CAC refers to the resources and costs incurred to acquire an additional customer. Customer acquisition cost is a key business metric that is commonly used alongside the customer lifetime value (LTV) metric to measure value generated by a new customer.

Let's say that CAC is 100£. We spent 100£ to get one customer to buy for the very first time a subscription from us. Customer spent 50£ but only 33£ of them are Profit, 27£ are cost. This is what we have made in the first month of our relationship with customer.

Customer Lifetime Revenue by Cohort

Can we effort to spent 100£ per customer on the marketing?

We are starting to be profitable on the 4th month from the customer initial purchase. Yes, we can effort it.

ROAS = return on ad spend

ROAS = 261 / 100 = 2.6